UPSTREAM ECONOMICS for NON ECONOMISTS

Learn and understand key upstream economic decision making concepts through a self built Excel economic model exercise

- Course Type

Short Course - Duration

3-5 days - Thematic

Fundamentals of E&P - Location

- Country

ANYWHERE -

Satisfaction rate

Who Should Attend?

Non-economists industry professionals working in or for the oil and gas upstream industry or government organizations. The course has been designed for a mixed professional audience of managers, subsurface and surface engineers, accountants; audit, trading, legal and finance staff. As Excel will extensively be used during the course, a minimum numerical and graphic knowledge of Excel is a plus.

Why should you attend?

Key strategic decisions such as investments, negotiations, mergers and acquisitions, divesture... are supported by financial models designed by the economist of the organisation. These models reflect the synthesis of a multi-discipline team study.

Attending this course is useful for staff who help build these models as well as for those who analyze reports in data rooms or as government representatives and advisors in the course of the exchange process between a company and the government of the host country.

Understanding upstream petroleum economics is also essential for career development.

Main Objectives:

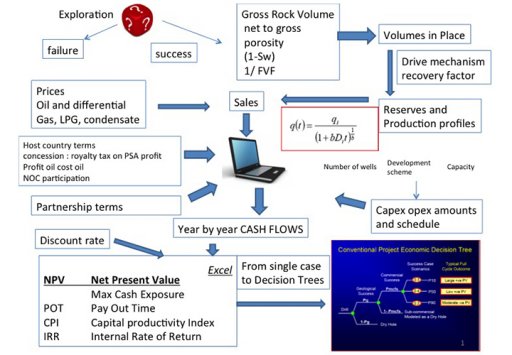

- Acquire a global vision of an oil and gas field full cycle from a management perspective

- Get a better feel of the contribution of each discipline in establishing a decision model : static reserves, dynamic reserves, conceptual design scenarios, cost estimating, trading and prices forecast, fiscal terms and legal aspects, risk and uncertainty

- Learn and use upstream economics principles by being an economist during the training session and explore different situations where economic models are used.

- Become familiar with the underlying structure of the numerical spreadsheet models that were run to generate the tables and graphs of economic and valuation reports.

- Discover some Excel features that may be useful for they own work

Learning Approach:

This interactive course must be considered as a pure workshop. It only requires personal portable computers with XLS software.

The learning approach differentiates from traditional petroleum economic courses where attendees are delivered an already built model that they run and which outputs are interpreted on different cases.

The driver of this course is to learn upstream economics principles by building together a simplified economic decision model adapted to the situation of the country or the corporation projects. This is feasible because the model will be built in a simple, robust, modular and structured generic template developed by the trainer for programming his own worldwide models.

The course is designed for an audience of 10 to 15 people organized in small groups of 2 to 3 people that share the same computer. In order to favour group interactions, we recommend that groups are constituted of people from different disciplines.

At each step of the model creation, a discussion is initiated with the participants about the new input data, formula, result or graph. When the discussed input corresponds to a participant’s discipline, he is invited to provide some insights to the group.

In the end, each group of participants owns and controls the model he has built. Once the model is successfully completed, the next step is to run it through several simulations situations and cases corresponding to real life decision choices.

Importantly, the model should only be used as a training and personal simulation tool. It is not aimed at competing with the corporate model.

HSE requirements:

No specific requirement for this course that can take place in any meeting room equipped with computers and a screen with common HSE characteristics, in your company premises or elsewhere

Course Agenda:

Day 1: Excel refresher session and upstream industry overview

Day 2: Full cycle field work program entry

Day 3: Pre-tax and after-tax Cash Flows programming

Day 4: Economic metrics and graphs generation

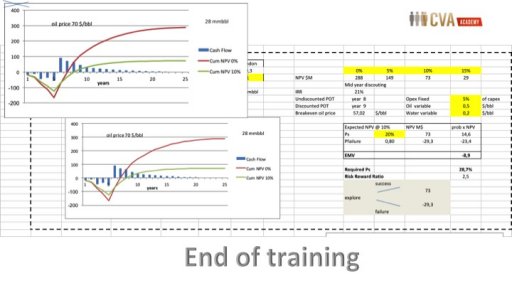

Net Present Value, Breakeven price, Internal Rate of Return, Pay Out Time, Maximum cash exposure, Capital Profitability Index

Day 5: Simulations and interpretation in different situations

Time permitting: Handling risk and uncertainty, chances of success and reserves distributions, probabilistic scenarios and decision trees, stochastic prices generation

Prerequisites

The course has been designed for a mixed professional audience of managers, subsurface and surface engineers, accountants; audit, trading, legal and finance staff. As Excel will extensively be used during the course, a minimum numerical and graphic knowledge of Excel is a plus.

Lecturers

-

ZAIMI A.Upstream petroleum economist and engineer with more than 30 years experience. He has worked for industry, government and more recently research. He was involved in a wide range of offshore and onshore, oil and gas project evaluations cases in different countries. During this training, he will share his working methodology based on interviewing the different departments for gathering the key data, designing robust decision models and delivering his analysis to decision makers in a comprehensive way.

ZAIMI A.Upstream petroleum economist and engineer with more than 30 years experience. He has worked for industry, government and more recently research. He was involved in a wide range of offshore and onshore, oil and gas project evaluations cases in different countries. During this training, he will share his working methodology based on interviewing the different departments for gathering the key data, designing robust decision models and delivering his analysis to decision makers in a comprehensive way.